OFFA, KWARA. Yusuf Kabeerah, a woman in her early thirties, recently bought new cartons of fish when Nigeria’s cashless policy dawned on her. She did not realize that the policy would have an impact on her business, so she continued selling and receiving old notes. However, when the old naira notes were redesigned, she, along with tens of thousands of Nigerians, found it challenging to return the old money to commercial banks for a swap to the new notes. But that is not the only challenge she faced. With a shortage of cash in circulation, her business is going sideways.

“Before this hard time, my smoked fish and fried ones would all be purchased no matter the number of cartons that I buy. But as a result of this cashless policy, half of a carton now takes two days or more before it meets its end,” the mother of two told THE LIBERALIST.

In October 2022, the Central Bank of Nigeria announced an ‘expiry date’ for the old notes of N200, N500 and N1000 to bring freshly redesigned ones into the economy. This was argued to curtail corruption, terrorism financing, and inflation that have negatively impacted the nation. Since then, the policy has been critically condemned for the hardship it has brought to the citizens.

“During the COVID-19 period, we saw the negative impact of physical cash. No one could go anywhere. We couldn’t go to the banks. People couldn’t leave their homes. It was the electronic banking system that protected and served those below the poverty lines that had their livelihood at risk,” said Aisha Ahmad, the CBN deputy director, while addressing the reasons for the cashless drive.

But to Kabeerah, the cost of CBN’s aspiration is just too great for her to bear. The policy has plunged her into a cash crisis amidst different difficulties.

“I can’t see the new notes anywhere, and this means no more fish for me where I’m buying it because some of them are not accepting transfers. I was dejected the last time I went there to buy fish because I only see N2,000 out of the 10,000 that I wish to withdraw, the money is still dirty and torn like rags. Although I have the money in my bank account, I struggled to pay the tuition fees of my children because of this issue,” she added.

Unfortunately, Kabeerah is not alone in this dilemma. This is the situation of many millions traders and small scale business owners across the country. One of them is a vegetable seller in Kara Market of Ajase-Ipo town of Irepodun Local Government Area of the state, who prefers to be identified simply as Omobolanle. With worries written all over her face, she explained to this reporter that low patronage would soon eat her business up.

“I am not comfortable with the cashless economy. I went through a lot of stress before I saw a POS to give me cash in this rustic area. Even if I see cash, the charges they’re deducting are killing. I’m concerned because my goods are perishable, and the cost is now going up like a rocket when I make little profit,” Omobolanle narrated.

A Threat to Economic Freedom – Experts Weigh In

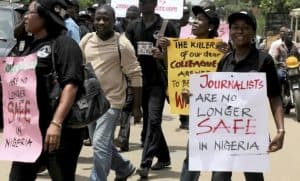

Across the country, the naira redesign and the cashless policy has caused more harm than the good. According to media reports, there were violent protests in different states, with banks burnt down, people slumping when trekking to the office, negative impacts on mental health, and causing depression to vulnerable people. The people in the rural parts of the country are the most hit.

While the policy may be legal and have the potential to boost the national income, experts argue that proper procedures are not being followed and that the policy is not yet capable of applying to small-scale businesses.

Legal practitioner Ridwan Oke argues that the government should obey the recent judgement of the Supreme Court, which postpones the deadline for the old notes to be phased out to December. This will allow for proper deposit in banks and ease transactions for business owners.

“How would you implement a cashless policy when electronic transactions are not working perfectly in the country? This is not good enough,” said Oke.

“I urge the government to obey the recent judgement of the Supreme Court which says the deadline of the old notes should be postponed to December so as to allow proper deposit in banks and ease transactions for business owners.”

Emmanuel Kilaso, a celebrated expert of the circular economy, opined that “the Nigerian government needs to give financial institutions the robust support needed to reduce the hardship citizens face daily.”

“People are using their productive time to queue for long hours in banks, our Gross Domestic Product cannot grow if we continue like this so banks need to work on the issue of connectivity for their mobile apps, ATM and POS machines. Cashless economy will cut financial crimes and wastage but we need time,” said Kilaso.

Mohammed Taoheed is a Fellow of Journalism for Liberty Fellowship and freelance journalist based in Sokoto based in Northwest Nigeria.